Homeowners Insurance in and around Everett

If walls could talk, Everett, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Everett

- Lynnwood

- Mill Creek

- Bothell

- Marysville

- Silver Lake

- Snohomish

- Lake Stevens

- Shoreline

- Edmonds

- Silver Firs

- Granite Falls

- Clearview

- Chelan

- Monroe

- Sultan

- Startup

- Kirkland

- Mukilteo

- Arlington

- Skykomish

- Gold Bar

- Seattle

Insure Your Home With State Farm's Homeowners Insurance

Being at home is great, but being at home with coverage from State Farm is the cherry on top. This fantastic coverage is more than just precautionary in case of damage from blizzard or fire. It also has the ability to protect you in certain legal situations, such as someone hurting themselves in your home and holding you responsible. If you have the right coverage, these costs may be covered.

If walls could talk, Everett, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

Home coverage with State Farm is the right move. Just ask your neighbors. And reach out to agent Tony Edwards for additional assistance with choosing the right level of coverage.

There's nothing better than a clean house and protection with State Farm that is dependable and commited. Make sure your belongings are covered by contacting Tony Edwards today!

Have More Questions About Homeowners Insurance?

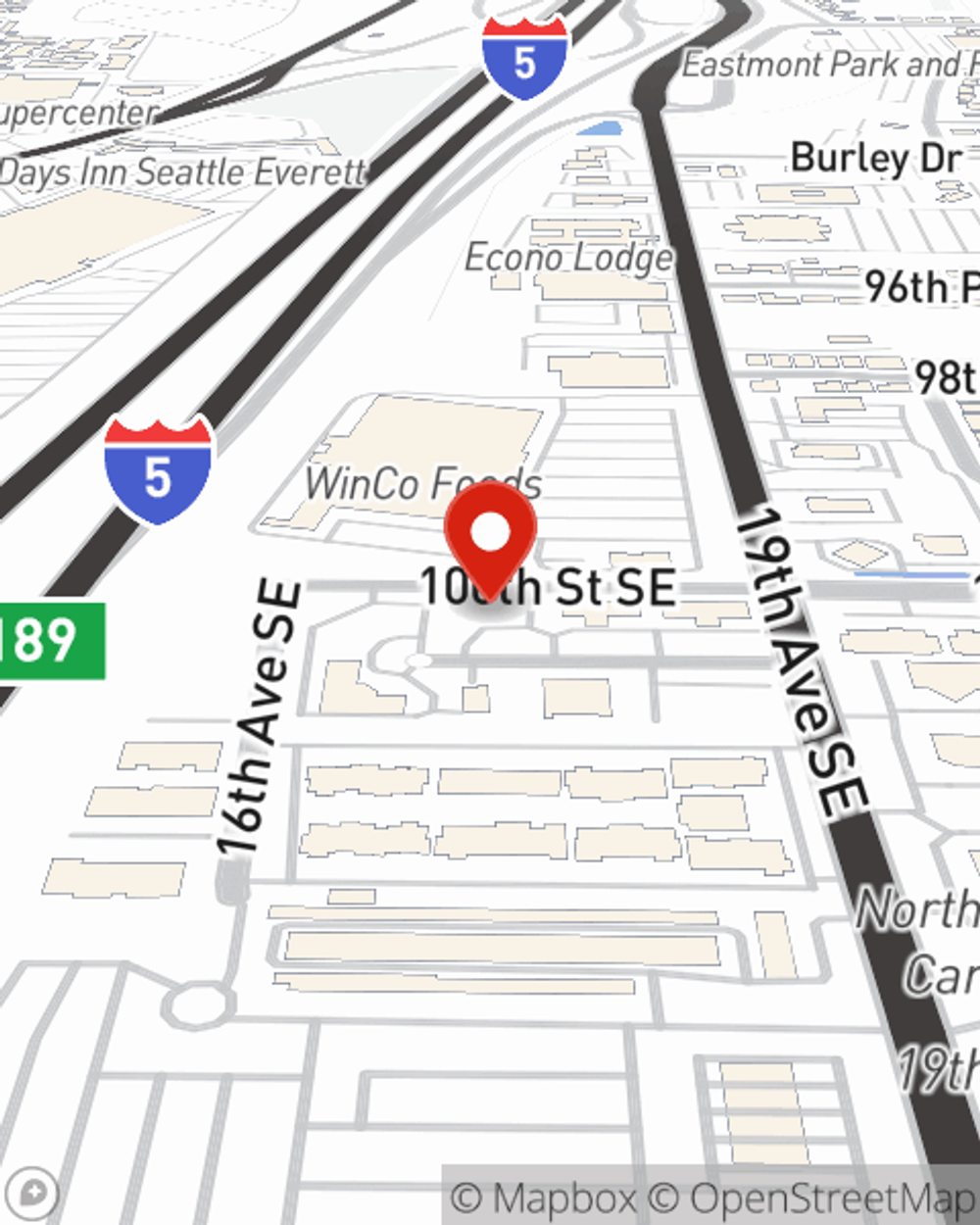

Call Tony at (425) 337-4800 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to include in an emergency kit

What to include in an emergency kit

Having emergency kit supplies prepared ahead of time may give you the resources you and your family need to stay safe.

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

Tony Edwards

State Farm® Insurance AgentSimple Insights®

What to include in an emergency kit

What to include in an emergency kit

Having emergency kit supplies prepared ahead of time may give you the resources you and your family need to stay safe.

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.